Section 179 calculator

In this article Calculate. This Section 179 Deduction Calculator for 2022 may very well help in your decision as Section 179 will save your company a lot of money the deduction is at a robust 1080000 and will stay there for the entirety of 2022 How much money can Section 179 save you in 2022.

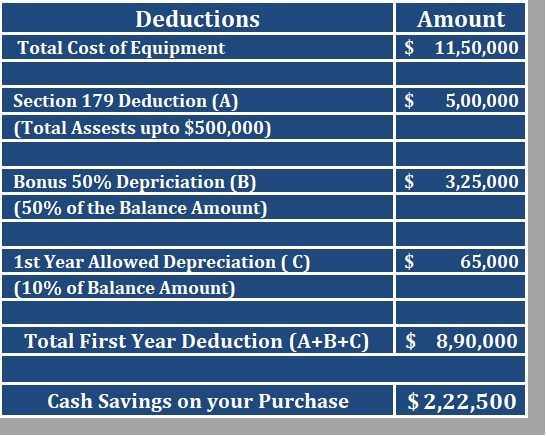

Section 179 Calculator Ccg

The Section 179 deduction generally is barred for vehicles.

. However for those weighing more than 6000 pounds -- many SUVs meet this weight threshold -- theres a. Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture using a 1031 exchange. Under Section 179 you can claim a deduction in the current year.

The list of vehicles that can get a Section 179 Tax Write-Off include. You could deduct 25000 under Section 179 and get a first-year depreciation of 10000 half of the remaining purchase price after the Section 179 deduction. Learn More About Section 179.

Well continue to share updates and the ways we can help you. Or you can use a 1031 exchange to defer depreciation recapture taxes. Heavy SUVs Pickups and Vans that are more than 50 business-use and exceed 6000 lbs.

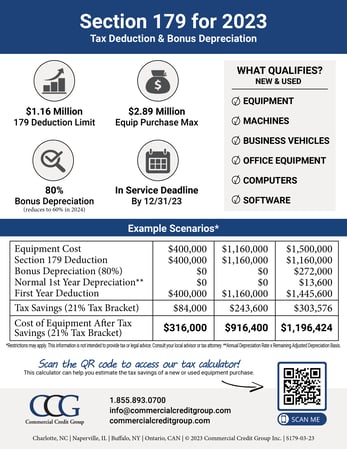

Applying for equipment financing could be the most profitable decision you make for your business and your 2022 tax returns. Savings refer to the reduction in the energy and power costs of the combined energy for the interior lighting HVAC and hot water systems as compared to a reference building that meets the minimum requirements of ASHRAE Standard 901-2007 for properties placed in service on or before December 31 2020. Section 179 can do wonders for your books especially if your company is in need of positive cash flow.

Just enter your equipment cost below. Federal income tax purposes. What Vehicles Qualify for the Section 179 Deduction in 2022.

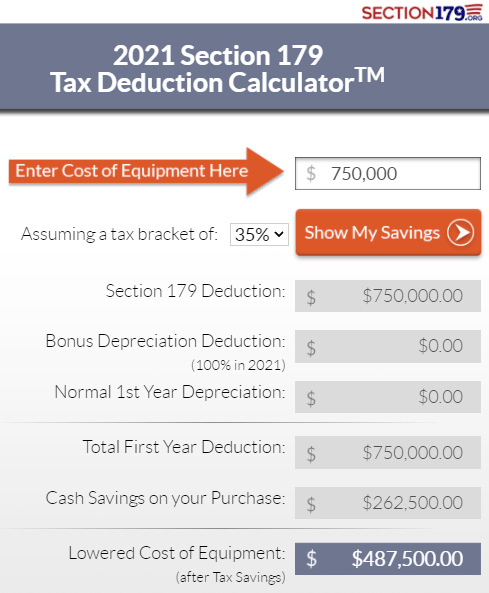

Section 179 Calculator. In addition there are IRS tax forms and also tools for you to use such as the free Section 179 Deduction Calculator currently updated for the 2022 tax year. That means youre able to deduct up to 1050000 in 2021 for the purchase of new or used equipment software and other assets.

Advanced Subnet Calculator is a good free Windows software being part of the category Networking software with subcategory Internet Utilities and has been published by SolarWinds. Customer Updates Regarding COVID-19. E Notation E notation which is also referred to as exponential notation is like scientific notation in that it involves multiplying a decimal number between 1 and 10 by 10 raised to a.

Section179Org successfully petitioned Congress to raise the Section 179 limit and with your support well ensure it remains strong. High Definition Twin Head Plasma Hi-Speed Plasma Flame Profiling Laser Cutting. And then use the section 179 exclusion.

In a calculator or computer E or e which stand for exponential are employed to denote the power of 10. Its reduced dollar-for-dollar for qualified expenditures more than 2 million. Leveraging Section 179 of the IRS tax code could be the best financial decision you make this year.

Gross vehicle weight can qualify for at least a partial Section 179 deduction plus bonus depreciation. Since the deduction was created with all businesses in mind the list includes purchases that many companies need. Heavy vehicles have a Section 179 deduction cap of 25000.

Its available for users with the operating system Windows 2000 and former versions and it is only available in English. Youd do this by deducting all or a portion of the cost of certain property as opposed to depreciating it. This means a taxpayer may elect to treat the cost of any Section 179 property as an expense and allowed as a deduction for the taxable year in which the.

A Ram truck is generally considered Section 179 property for US. Section 179 Calculator. The impact of COVID-19 coronavirus on small businesses continues to change quickly.

26200 for SUVs and other vehicles rated at more than 6000 pounds but not more than 14000 pounds. The amount of taxable income from an active trade or business. Flexible Fast and Hassle-Free Financing For Your Industry.

Section 179 Deduction Calculator. The Section 179 Tax Deduction covers business supplies upgrades improvements and property that is purchased or leased in the same calendar year. The multiplicative inverse of a modulo m exists if and only if a and m are coprime ie if gcda m 1If the modular multiplicative inverse of a modulo m exists the operation of.

Calculate your potential savings with our 2022 Section 179 tax deduction calculator. This PERT calculator can be employed for swift computation of the likelihood of your project being completed within the desired timeframe on the basis of the Program Evaluation and Review Technique PERT. Special rules for heavy SUVs.

You can claim the Section 179 deduction when you placed these types of property into service during the tax year. The Section 179 deduction is limited to. When you finance equipment you can get the latest model while enjoying accelerated tax benefits through Section 179.

Learn how tax benefits for equipment financing make it easier to keep more cash in your pocket. SIGN YOUR APPROVAL FOR SECTION 179 Your voice matters. Payments Repayments Calculator.

Let us say you finance a 45000 heavy SUV and use it 100 for your small business. If you couple this dollar-for-dollar reduction to taxable income. The modular multiplicative inverse of an integer a modulo m is an integer b such that It may be denoted as where the fact that the inversion is m-modular is implicit.

The maximum Section 179 expense deduction is 1050000. Qualified tangible personal property. Read more about these strategies.

The Current State Of The Section 179 Tax Deduction

Write Off Your Entire Purchase In 2021 With Section 179 Deduction Advancedtek

Bellamy Strickland Commercial Truck Section 179 Deduction

1 Million Tax Break It Pays To Know About The Section 179 Deduction

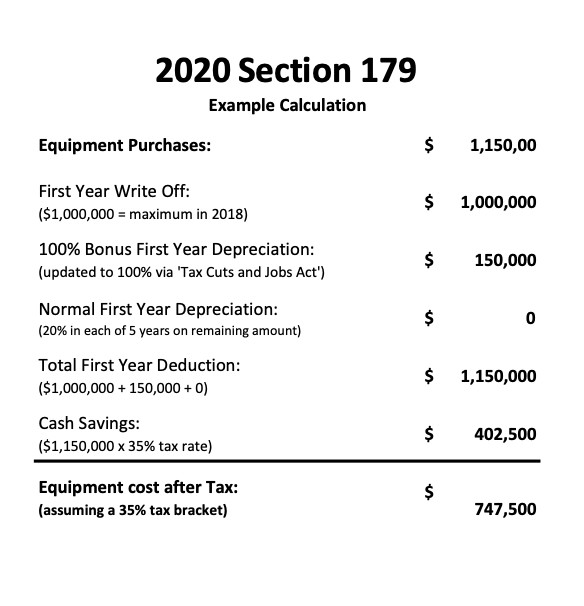

2020 Section 179 Deduction Example Section179 Org

2020 Section 179 Commercial Vehicle Tax Deduction

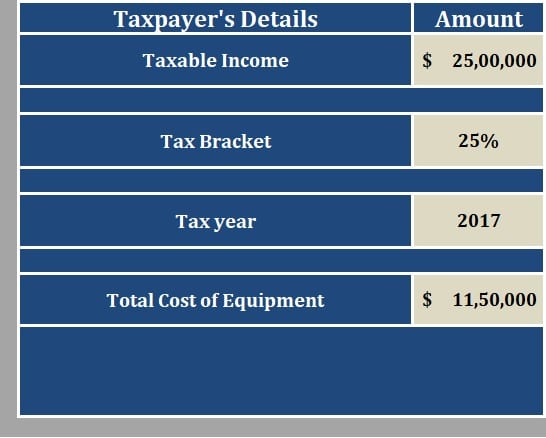

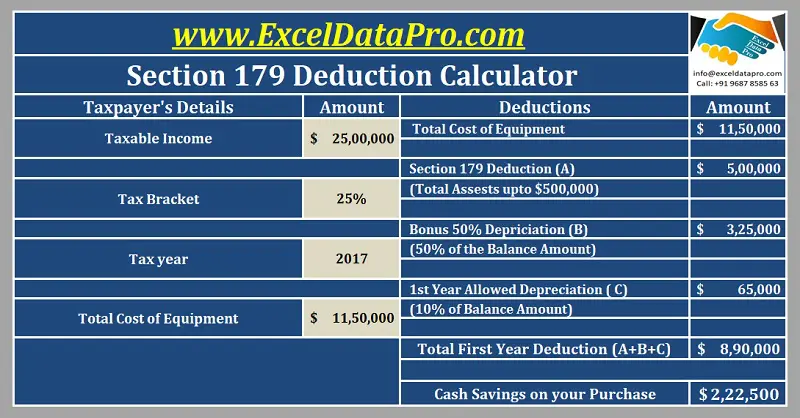

Download Section 179 Deduction Calculator Excel Template Exceldatapro

2022 Section 179 Tax Savings Your Business May Deduct 1 080 000 Youtube

Write Off Your Entire Purchase In 2020 With Section 179 Deduction Advancedtek

U Shaped Double Winder Staircase Calculator Half Turn Stair Switchback 180 Stair Plan Circular Stairs Stair Dimensions

Section 179 Deduction Fmi Truck Sales And Service Oregon

Write Off Your Entire Purchase In 2021 With Section 179 Deduction Advancedtek

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Pin On Social Awareness

2021 Section 179 Tax Savings Your Business May Deduct 1 050 000 Youtube

Section 179 Calculator Ccg